India-US trade deal decoded: What does it mean for economy, markets & Russian oil imports? Explained in 10 charts – The Times of India

Has India managed to secure the ‘father of all deals’ with the US? American President Donald Trump and Prime Minister Narendra Modi took everyone by surprise this week when they announced that the tariff rate on Indian goods to the US will be reduced to 18%. While a trade deal remains to be signed, and final nuances are being worked out, the stalemate in ties has finally ended, paving the way for two big world economies to resume normalcy in trade ties.The US is India’s single largest trading partner, and the 50% tariffs imposed by the Trump administration had hit exporters. With an 18% tariff rate, India’s exports are back to being competitive. Trump’s Truth Social Post spoke of several aspects to the deal including what he claimed was commitment to stopping Russian crude and also buying $500 billion worth of American goods.

Even as details of trade deal emerge, we explain the importance of the agreement for India in top 10 charts: Take a look:

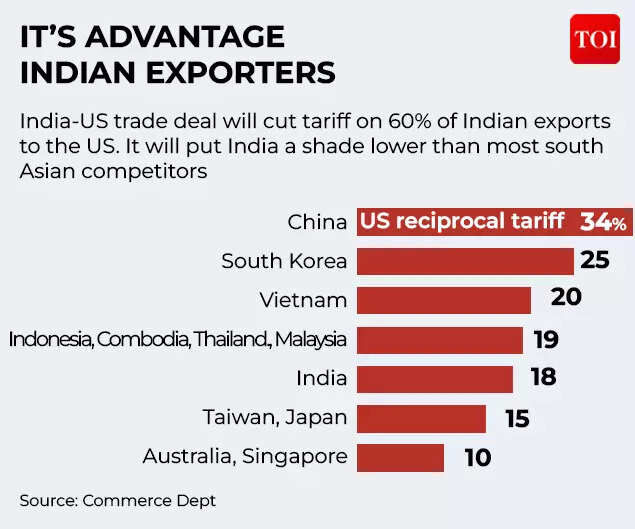

Comparative advantage for India

With an 18% tariff, India has managed to secure a deal which places its duty rate lower than its neighbouring countries and competitors. Some of the main countries which compete with India’s labour-intensive sectors in the global markets are: Vietnam (20%), Malaysia (19%, Bangladesh (20%), Cambodia and Thailand (19%), China (34%). India has also got a lower rate than Pakistan which gets tariffed at 19%.

It’s Advantage Indian exporters

Commerce minister Piyush Goyal has also stressed on this point, saying that India got a ‘very good’ deal with the US, better than the competitors.Agneshwar Sen, Trade Policy leader, EY India says that the biggest takeaway is that India has shifted from being a passive tariff-hit exporter to a partner with a negotiated stake in the US market.“For India, the deal matters less for the headline concessions and more for what it signals. Since the new tariff rates will come into effect immediately, to start with it will arrest the export erosion we have been facing. India was steadily losing competitiveness in the US because the high tariffs were wiping out marginal advantages of quality and dependability. The deal will effectively cap further damage and restore predictability, allowing exporters to price, plan and retain market share rather than bleed slowly,” he tells TOI.“It will reinforce India’s credibility as a supply-chain alternative. The deal positions India as a reliable, lower-risk sourcing partner at a time when US buyers are seeking to de-risk from China,” Sen explains.

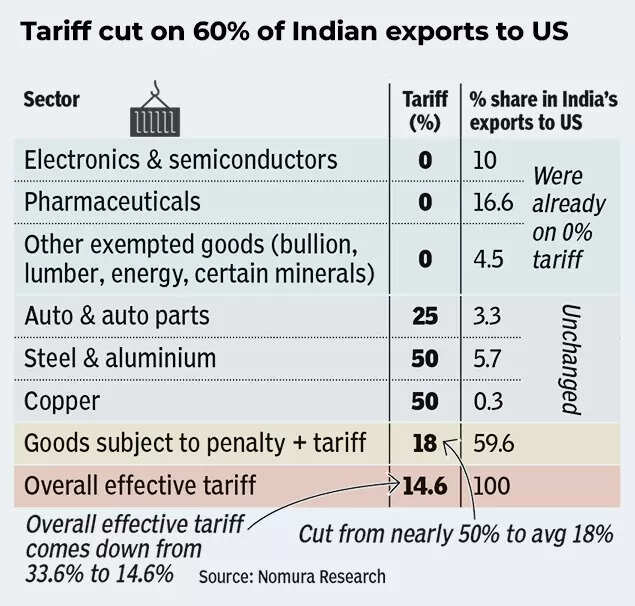

Tariff cut on 60% of Indian exports to US

“Finally, it will nudge Indian exporters to move up the value chain. Tariff relief will push Indian firms toward scale, compliance and higher value manufacturing, rather than operate on pure price arbitrage. The bottom line is that the deal doesn’t just recover lost exports – it reanchors India in the US market – and on a more durable, strategic basis, which is far more valuable over the medium term,” Sen adds.Gulzar Didwania, Partner, Deloitte India also highlights the important point that India has secured a level playing field in terms of tariff treatment vis-à-vis key competing economies in South Asia such as Vietnam, Bangladesh and Sri Lanka.“Unlike earlier situations where some countries enjoyed distinctly preferential access, India is now broadly aligned within the same tariff bracket, reducing relative disadvantages for Indian exporters,” he tells TOI.

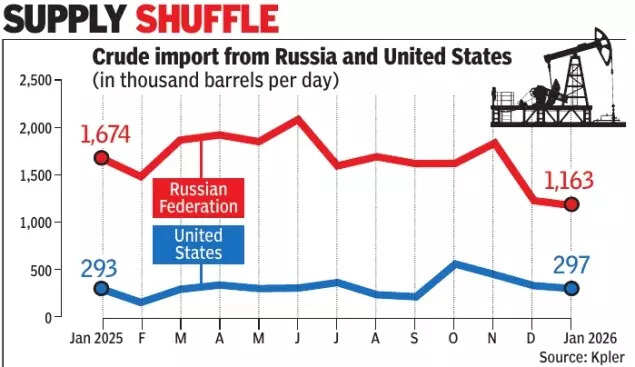

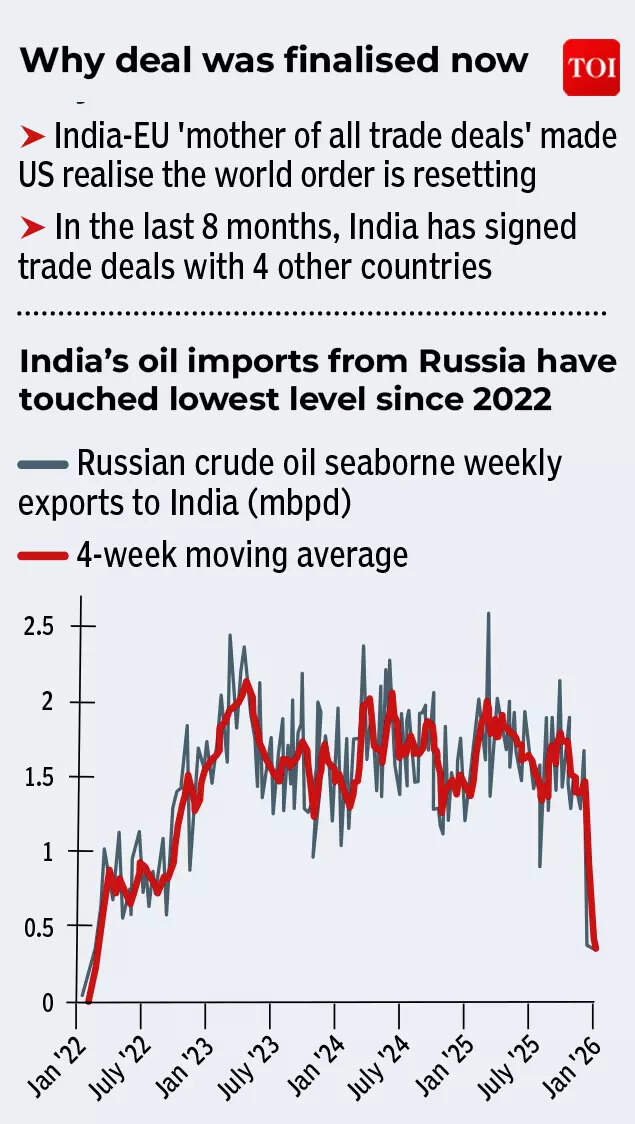

Will India stop buying Russian oil?

As part of the newly announced trade deal, US President Donald Trump claimed that India would stop buying Russian oil. “We spoke about many things, including Trade, and ending the War with Russia and Ukraine. He agreed to stop buying Russian Oil, and to buy much more from the United States and, potentially, Venezuela,” Trump posted on Truth Social. Meanwhile, Russia has maintained that it received no official communication from India on the matter. Kremlin spokesman Dmitry Peskov said, “so far, we haven’t heard any statements from New Delhi on this matter.”According to officials, imports from Russia have already been declining since November after the US imposed sanctions on major exporters Rosneft and Lukoil.Data from Kpler show Russia’s share of India’s crude imports fell to 33.7% between April and November 2025, from 37.9% in the same period last year. Over the same time, US share rose to 8.1 per cent from 4.6%. In absolute terms, Russian crude imports dropped from about 1.8 million barrels per day in November to 1.2 million in December and 1.16 million in January 2026.

Supply shuffle of oil

Despite this trend, analysts say the trade deal is unlikely to result in an immediate or sharp fall in Russian supplies. “The deal is unlikely to result in a near-term reduction in India’s Russian crude imports. Russian volumes remain largely locked in for the next 8-10 weeks and continue to be economically critical for India’s complex refining system, supported by deep discounts on Urals relative to ICE Brent,” said Sumit Ritolia, lead research analyst at Kpler.According to experts Russian imports will remain broadly stable through the first half of 2026–27, with any further moderation likely to be balanced by higher inflows from West Asia. A recent SBI Research report suggests that India could potentially save almost $3 billion in its crude imports bill annually, by redirecting part of its Russian oil purchases to Venezuela.The report said replacing some Russian crude with Venezuelan heavy crude could deliver meaningful savings for India, even after accounting for higher freight, logistics and related costs. It noted that Venezuelan crude would need to be priced at a discount of about $10–12 per barrel to make the switch commercially workable for Indian importers.SBI said, “India’s fuel import bill could even decline by $3bn in the event of shifting to Venezuela… discount of $10–12 could make the choice agnostic.”According to Oil Price data cited in the report, Venezuelan heavy crude is currently trading at around $51 per barrel. The study further added that the actual benefit would depend on several factors, including the size of the discount compared with Brent crude, longer shipping routes, and additional time and insurance costs associated with sourcing oil from Venezuela.

How does a trade deal with the US benefit India?

The India–US trade deal cuts tariffs on almost 60% of Indian exports to the US, lowering reciprocal duties to 18% from 50%. The agreement is expected to deliver a clear boost for exporters while also supporting GDP growth and investor sentiment.Sectors ranging from garments, leather, footwear, carpets, shrimps and gems and jewellery are set to benefit, as Indian products will become more competitive in the US market. For garments, the 18% levy is marginally lower than the 20% faced by Bangladesh and Sri Lanka. Meanwhile, the jewellery and gems sector is also waiting for the deal’s fine print.With tariffs now rolled back, uncertainty has also eased sharply. “We estimate an incremental boost of around 0.2 percentage point of GDP (annualised), if the new lower tariffs are enforced,” Goldman Sachs said, adding that the estimate is based on India’s goods exports exposure of roughly 4% of GDP to US final demand and a goods export demand elasticity of about 0.7.

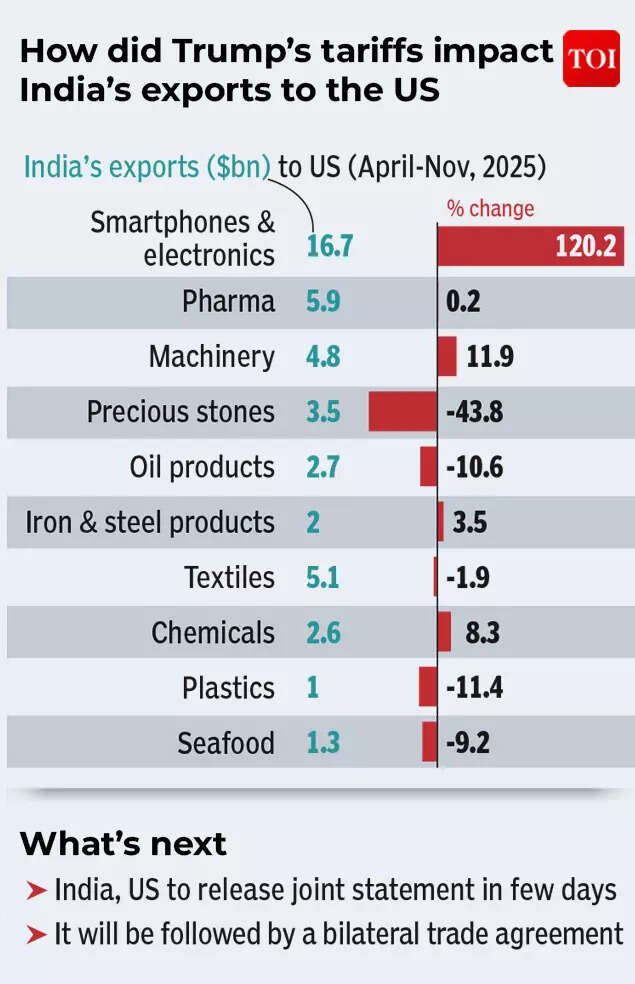

How did Trump’s tariffs impact India’s exports to the US?

Earlier estimates had suggested a GDP impact in the 30–50 basis points range. Barclays said, “Statistically speaking, we estimate lower tariffs will add 30 basis points to headline GDP growth (essentially reversing the threat posed by 50% tariffs until now).”Latest projections show the economy growing 7.4% in the current fiscal year ending March, with growth for FY27 seen in the 6.8%–7.2% range. Moody’s Ratings said the reduction in US tariffs on most Indian goods would reinvigorate exports to the US, India’s largest goods export market, accounting for about 21% of total goods exports in the first eleven months of 2025.Arvind Shrivastava, secretary, department of revenue, said that the deal would deepen trade ties and create new opportunities for labour-intensive and manufacturing sectors, while also giving a push to collaboration in high and advanced technology areas. M. Nagaraju, secretary, department of financial services, said that the rollback to 18% lifted the “dark clouds of uncertainty” and would help exporters.

Eyeing a level playing field

For exporters, especially smaller firms that had slowed or halted shipments, the timing is critical. With summer consignments already dispatched and fears looming over the next season, the tariff cut has restored competitiveness and eased pressure after months of discount-led survival.

Stock markets and rupee cheer

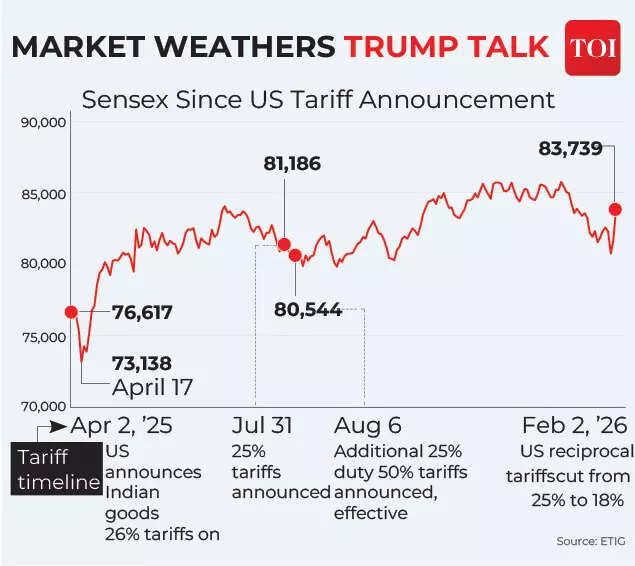

The Indian stock market and rupee which have been hit badly by the persistent outflow of foreign investors’ money have taken a breather – both rallying strongly after the trade deal announcement. The surge in Sensex left Indian investors richer by a massive Rs 12 lakh crore on Tuesday! In fact, it was the fifth biggest single-day gain in history. The market had been languishing, with some spurts of rallies and some downturns in the last few months, waiting for the conclusion of the trade deal which lifted clouds of uncertainty.

Market weathers Trump talk

Market experts expect the rally to continue as more details of the trade deal emerge in the coming days.“With this deal announcement, we believe that the market will now begin to accord correct weightage to the improving trajectory of corporate earnings growth, which has shown successive improvement over the quarters with an improving earnings revision trend,” Motilal Oswal Financial Services said in a report.

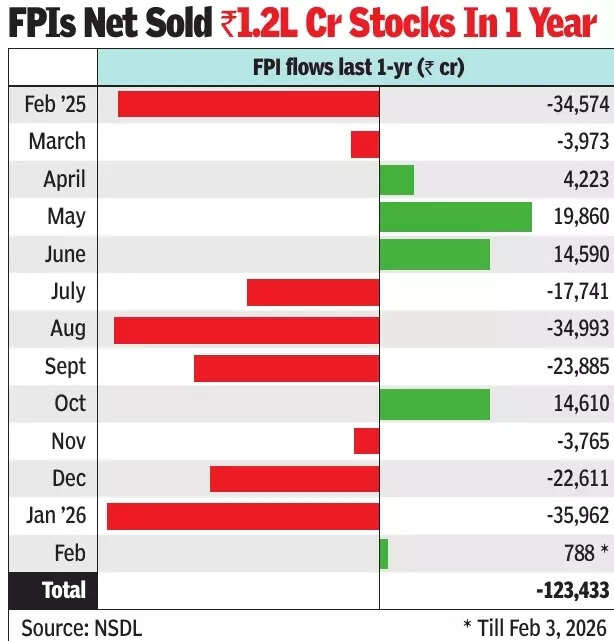

FPIs net sold Rs 1.2 lakh crore stocks in 1 year

“This is a high-impact development and will have a multi-layered positive effect on the Indian economy, prevailing market sentiments, and sectors exporting to the US, which will benefit from better competitiveness,” it said.Tuesday’s rally was proof that the announcement has been met with cheer from foreign institutional investors as they led the rally, with their net inflow in stocks at Rs 5,236 crore.

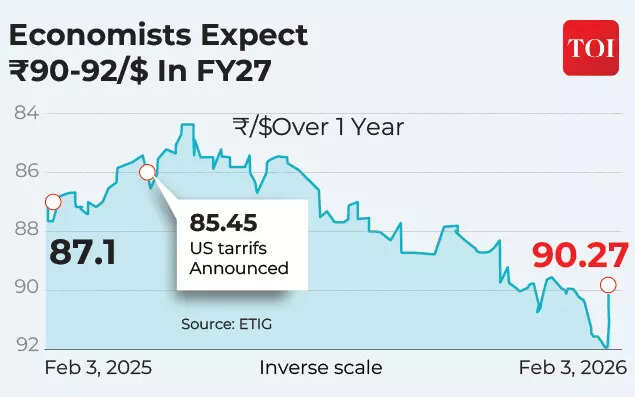

Rupee outlook

The Indian rupee, the worst performing Asian currency last year, appreciated 124 paise to 90.27 against the dollar. It logged its strongest single-day gain in seven years and the best since late 2018.

What happens to agriculture, dairy sectors?

Trump’s announcement that India has agreed to “BUY AMERICAN” at a higher level than before triggered concerns, particularly over agriculture. Since trade negotiations began, India has drawn a firm line on protecting its dairy and farm sectors.Piyush Goyal has clarified that the priorities still have not shifted and the dairy and agriculture sectors are still protected. Speaking in Lok Sabha, the minister said, “during negotiations, the Indian side successfully ensured the protection of its sensitive sectors, particularly agriculture and dairy,” he said, noting that the US too had areas it considered sensitive.On the US side, trade representative Jamieson Greer also confirmed that though India agreed to cut tariffs on industrial goods to zero from 13.5%, the agriculture segment is still safeguarded.Agriculture has long been the biggest flashpoint in India-US trade talks, with Washington pressing for greater access to India’s dairy and agricultural markets. US commerce secretary Howard Lutnick had even accused India of shutting out American farmers, questioning why it would not import “even a bushel” of US corn.The decision to safeguard the sector is not solely commercial, rather it is non-negotiable. The agriculture and dairy sector sits at the heart of rural life and food security. Farming and allied activities, including animal husbandry, support the livelihoods of over 700 million people.India is largely self-sufficient in food production, while countries such as the US, Australia and the European Union treat agriculture as a major export business. Opening Indian markets to heavily subsidised farm products from these regions could flood the country with cheap imports, sharply undercutting farmer incomes.India already maintains agricultural tariffs ranging from zero to 150%. The US also follows a similar approach, imposing steep duties on select products such as tobacco, which attracts tariffs of up to 350%.

What led to the sudden trade deal?

The ‘mother of all trade deals’ – the recently concluded India-EU Free Trade Agreement – may have been what finally spurred the Trump administration into action. According to a News Week analysis, it led the US government to blink.While discussions for a trade deal with the European Union had been ongoing, this time, “the trade agreement with the EU appears to have provided a strong goad for the US to wrap up the long-lingering negotiations with India,” says a TOI report.

Why deal was finalised now

Talks between India and the US for a trade deal had continued, despite the 50% tariffs imposed by the latter. While Trump and PM Modi continued to talk, Commerce Minister Piyush Goyal and External Affairs Minister S Jaishankar also engaged in talks with their respective counterparts. The arrival of the new US Ambassador to India Sergio Gor also seems to have worked to help push for the trade deal.Now, the wait for the fine printWhile experts and analysts have welcomed the news as a positive for the Indian economy, they also caution that details of the deal need to emerge for a better understanding of what it holds for each sector and the economy as a whole.

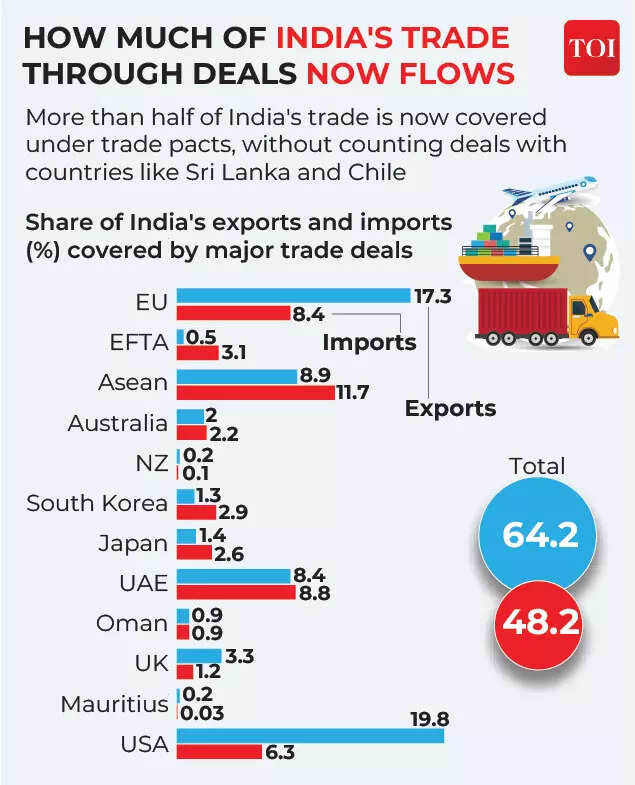

India’s trade through deals

Piyush Goyal has said that a joint statement by the countries will be issued soon.“Experience suggests caution. The US–Korea FTA showed how initial optimism can be diluted by ‘later’ safeguards and reinterpretations while recent tariff threats linked to Greenland-related geopolitical tensions underscore how strategic considerations can quickly reshape trade outcomes,” says JM Financial in a report.