Art of the deal: How India turned from ‘Maharaja of tariffs’ to global trade hub – The Times of India

“Prime Minister Modi and I are two people that get things done,” Donald Trump said on Monday, announcing that India and the United States had reached a trade deal after nearly a year of negotiations. Trump announced it in his trademark style on Truth Social, and with this, the “immediate” tariff reduction to 18% marked the end of a rough patch in US-India economic relations.Less than a year earlier, on April 2, a day Trump branded “Liberation Day” Washington had jolted global trade by unveiling reciprocal tariffs on most major economies.

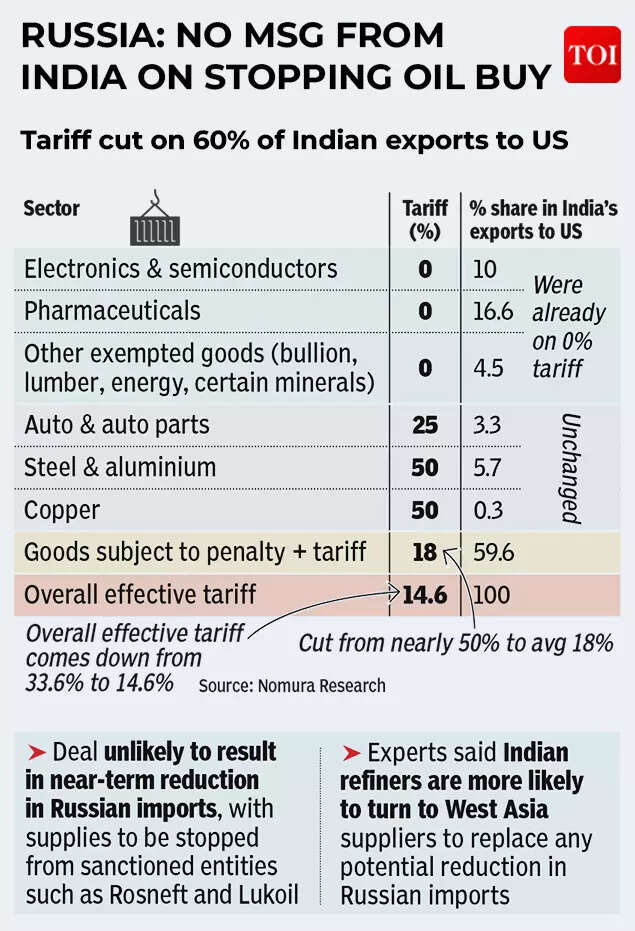

India was firmly in the crosshairs. Trump imposed a 26% reciprocal tariff on Indian goods, but was suspended to leave room for trade negotiations. However in August, a 25% tariff was imposed, which was later pushed up to a punitive 50%, partly in response to New Delhi’s continued purchases of discounted Russian oil.

.

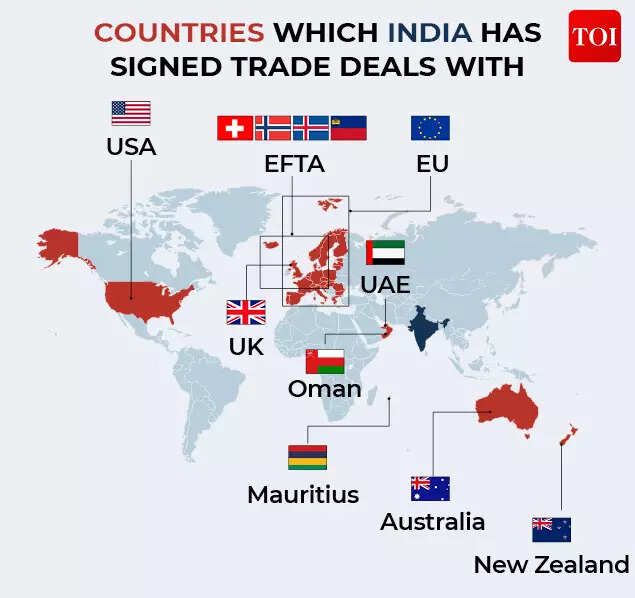

Yet New Delhi’s response was notably restrained. There was no retaliation, no public escalation, and no sudden scramble for exemptions. That calm was not accidental. For several years, India had been quietly preparing for precisely this kind of global uncertainty. Trade agreements, once viewed largely through a commercial lens, had been repurposed as tools of strategic insulation.By the time Trump’s tariffs landed, India was already deep into negotiating, and concluding, a web of bilateral deals across Europe, the Gulf and the Pacific. These pacts were designed to diversify export markets, lock in preferential access, attract long-term investment and reduce vulnerability to any single economic partner.What followed was not a retreat from global trade, but a carefully managed repositioning. So how did New Delhi insulate itself from global uncertainties?

.

A tactical compromise? The India–US ‘deal’On February 2, Trump abruptly announced a deal with India to ease the tariff conflict. The announcement puts India ahead of its South Asian neighbours like Indonesia, Pakistan and Bangladesh all of whom face tariffs of 19% and 20% respectively, while also putting it ahead of China, Thailand and Vietnam.White House officials later claimed that India has agreed to lower its own barriers on American goods and to halt its purchase of discounted Russian oil. US officials also said PM Modi pledged to “BUY AMERICAN at a much higher level,” including as much as $500 billion in US energy, agriculture and technology products. Trump further claimed India would reduce tariffs and non-tariff barriers on US goods “to ZERO”, though the precise timeline and scope remain unclear.

.

This “Mini-Deal” is seen by analysts as a tactical compromise rather than a grand bargain. JNU professor Rajan Kumar calls the 18% tariff “the second best deal” India could get under Trump, noting that expecting a preferential “special place” for India was “wishful thinking” given Trump’s tariffs on all partners. Kumar argues it is still better to have some agreement than none: “if you had no deal, it could have larger consequences” for trade and broader ties. Indeed, he highlights that even a modest deal unlocks deeper cooperation – for example on critical minerals, semiconductors and data – as well as joint political engagement on China and technology issues. In that light, India’s capture of an 18% cap on US tariffs (from 25%) is portrayed as a hard-won compromise that avoids a prolonged trade war.

.

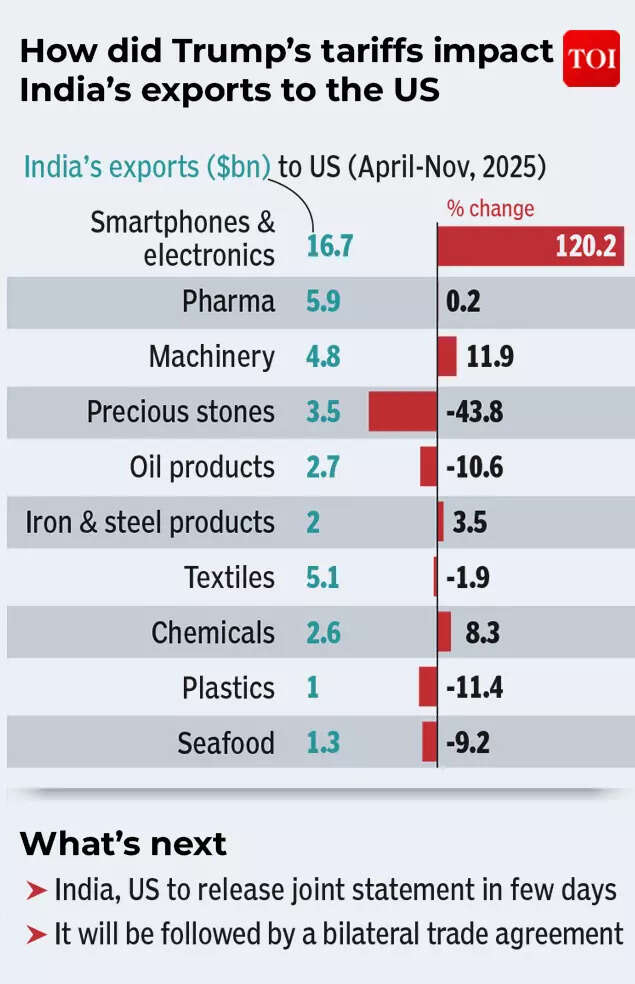

Much of the US pressure, notably the oil sanctions, was driven by political symbolism for the 47th POTUS. The Wall Street Journal reported that Trump’s higher tariffs were meant to punish India for “refusing to stop buying Russian oil,” which his administration tied to financing the war in Ukraine. Indian officials have long argued that the country’s Russia purchases are based on market economics and demands. After Trump-Modi talks, the US has reportedly agreed to lift a 25% penalty tariff (imposed via a “Russia tariff”). It is yet unclear whether India has committed to stopping Russian crude oil imports.In practice, analysts expect India’s imports of Russian crude to decline as global supply chains adjust, but not to stop overnight. Oil and gas remain a focal point: the US hopes India will buy American LNG and coal instead. There is also talk of some how India may buy Venezuela oil in lieu of Russian oil, but officials concede Venezuelan heavy crude is difficult and costly for many refineries.On balance, the US deal eases immediate frictions. By cutting US duties to 18%, it lifts a disproportionate drag on India’s exporters, especially in labour-intensive sectors. And as per Trump’s claims, it also comes with high-profile pledges of Indian investment in the US. For example, earlier US deals with Japan and Korea involved hundreds of billions in targeted investment, and US business groups hope similar commitments will follow for India. However, details matter. So far the agreement is only on broad contours; concrete implementation (start dates for cuts, exact product coverage, etc.) is still being worked out.Commerce minister Piyush Goyal said officials are preparing a joint statement that should be released within days, with final signing to follow soon. Until then, uncertainty remains over specifics like transition periods and safeguards.

.

Domestically, the US pact has mixed implications. Exporters of goods like textiles, gems, pharmaceuticals and machinery stand to benefit from more market access and lower US duties. As noted by Professor Harsh Pant, Vice President – Observer Research Foundation and Studies, high tech sectors will gain the most from the agreement.“Specific sectors, those which are labor intensive and export focused manufacturing sectors, and they would gain through improved US market access and competitiveness. Whereas you will have the high tech services sectors which will benefit from strategic ties and investment flows. Textiles, pharmaceuticals, gems and jewelry, auto components, engineering goods, seafood, marine products, chemicals, electronics, IT services, digital services,” Pant told TOI.To sum up, the India–US trade deal appears to end the punitive tariff while maintaining firm boundaries around sensitive sectors. It also serves larger strategic goals: It cements the India–US partnership in areas like energy and technology.The ‘Mother of All Deals’Even before Washington, New Delhi struck a much broader pact with Brussels. In late January India and the European Union announced the conclusion of a landmark Free Trade Agreement. On paper the India–EU FTA is staggering in scale: it would unite the fourth- and second-largest economies (by GDP) under a “modern, rules-based” trade framework covering virtually all goods and services. Under the draft deal, Indian exporters stand to gain duty-free access on more than 99% of India’s export value to the EU. This includes labour-intensive sectors like textiles, leather, gems and jewelry, as well as engineering goods, pharmaceuticals, electronics, medical devices, chemicals, plastics, handicrafts and many agri-products (tea, spices, marine items, etc). Goyal himself called it “game-changing and transformational”, and characterized the outcome as ending two decades of stalled talks.European leaders agree. EC President Ursula von der Leyen hailed the pact as cementing ties that have “never been stronger,” linking it to joint security cooperation. The Indian government’s official fact sheet calls it the “mother of all deals,” opening “unparalleled opportunities” in a combined market of two billion people. The FTA is designed to be comprehensive: beyond goods, it cuts red tape on services and investment, recognizes each side’s standards, and even includes clauses on digital trade and environment.

.

It also launched India’s first-ever EU security and defence partnership, signaling that economic and strategic alignment go hand-in-hand.In return, India agreed to eliminate or reduce tariffs on most EU exports. Europeans will win phased duty cuts on industrial products like automobiles, machinery and aerospace parts, as well as alcoholic beverages (whisky, wine, etc) under quota regimes. EU leaders are content to exempt a few sensitive categories (e.g. dairy, poultry remain barred).Taken together, the India–EU pact will reshape trade flows. By one estimate, EU members agreed to liberalize more than 97% of exports to India by value. If implemented, it could boost annual bilateral commerce from today’s ~$200 billion to a new high, benefiting Indian farmers and factories that supply the EU market. PM Modi called it a deal that will “stabilise the global order” by reinforcing fair trade rules. Commonwealth and pacific partnershipsIndia has also pursued deals with its Commonwealth and Pacific partners. Foremost among these is the India–United Kingdom FTA, signed in July 2025 during PM Modi’s London visit. This pact effectively doubles as a bilateral economic agreement aimed at trebling trade by 2030. Key features: 99% of Indian exports to the UK will enter tariff-free. Indian goods in labour-intensive sectors (textiles, apparel, leather, gems & jewellery, engineering products, marine products, and handicrafts) gain the most. In agriculture, the UK agreed to new access for many Indian food items (mango pulp, pickles, rice varieties, etc.), while higher tariffs remain on staples it cannot produce. Britain, in turn, will see sharp tariff cuts on its own exports: for example, UK cars tariffs fall from 15% to around 3%, and duties on whisky and gin will halve under quotas.The UK deal also liberalizes services and mobility. The agreement awaits UK parliamentary ratification, expected by late 2026. In practical terms, it means Indian exporters can now target nearly the entire UK market without customs duties, and UK investors can look forward to stable rules for major sectors. While politically sensitive on agriculture, the consensus is that both sides kept key red lines, making it a broadly win–win outcome.To India’s east, the New Zealand FTA concluded in December 2025 cements ties with an agriculture-rich Pacific country. Under this pact, all Indian exports to NZ will eventually face zero tariffs. New Zealand agreed to grant 100% duty-free access on every tariff line for Indian products, eliminating NZ’s previous 10% import duties on many Indian textiles, leather, auto parts and engineering goods. Gulf cooperationIndia has long prioritised the Gulf as a strategic partner. Its Comprehensive Economic Partnership Agreements (CEPAs) with the UAE (2022) and Oman (2025) reflect this. The India–UAE CEPA, India’s first with an Arab country, eliminated tariffs on about 97% of tariff lines on UAE goods. The pact paved the way for Indian exports in textiles, engineering goods, food products and professional services, while UAE firms gained better access for gold, metals and machinery. Services and investment flows also surged: the UAE became a gateway for Indian companies into West Asia and Africa, and hundreds of thousands of Emiratis invested in India’s infrastructure and stock markets as market restrictions were lifted.Building on that, Prime Minister Modi’s 2025 visit to Muscat culminated in the India–Oman CEPA. This agreement gives Indian exporters duty-free access to over 98% of Oman’s tariff lines – notably benefiting all major labour-intensive sectors. Products like Indian textiles, footwear, leather, gems & jewellery, plastics, furniture, food, auto parts and medical devices will enter Oman without tariffs.Gulzar Didwania, a partner at Deloitte India called the India-UAE CEPA, “the most comprehensive illustration of India’s evolving FTA framework.” He hailed the framework as one that “that simultaneously promotes employment generation, deepens technology collaboration, strengthens supply-chain resilience, and extends the same of strategic defence partnership between both nations”So what’s the outlook ahead?Signing deals is only the beginning. As Agneshwar Sen, Trade Policy Leader at EY India, notes, “the real test begins” after the negotiations are concluded. The key challenges now lie in implementation, compliance and strategic follow-through. Many of the newer FTAs, particularly with the EU and the UK, contain dense chapters on rules of origin, technical standards, conformity assessment and customs cooperation. Indian exporters, especially MSMEs, face a steep learning curve. Weak certification capacity, fragmented testing infrastructure and inconsistent interpretation at borders could blunt the expected gains.

.

Rules of origin present another hurdle. While tighter origin norms are designed to prevent trans-shipment, they also raise compliance costs. Without robust verification systems, credible data trails and active hand-holding by the state, exporters may simply forgo preferential access. Sen also points to rising standards and sustainability pressures, especially in EU-style agreements, where commitments on labour, environmental safeguards, traceability and carbon-related measures could test Indian manufacturing. Firms that fail to upgrade processes and documentation risk being priced out of markets despite tariff concessions.As Professor Kumar argued, private firms will continue to source oil or goods based on price and reliability, not external pressure.As noted by Sen, Institutional coordination is another fault line. Trade policy now cuts across commerce, finance, environment, labour, MSMEs and state governments. Misalignment between ministries could slow execution and undermine credibility. Gulzar Didwania, Partner at Deloitte India, underscores that while India has negotiated favourable frameworks, converting them into export growth, investment inflows and job creation depends entirely on domestic readiness. Supporting MSMEs to meaningfully participate in global value chains remains particularly critical, as many lack awareness or capacity to leverage FTA benefits.As Professor Kumar put it, bilateral FTAs have become “a real option”. Whether the “king of deals” strategy succeeds will depend less on headline signings and more on execution, competitiveness and reform. By pursuing nine major trade pacts spanning six regions within a few years, New Delhi is attempting to reposition itself from a tariff-heavy economy to a central node in global supply chains. As Pant told TOI, these agreements “signal to the world” that India and its partners are pursuing agendas that are not subordinate to either the US or China. In practical terms, the deals diversify India’s export destinations, reduce reliance on any single market, and lock in long-term access for key sectors ranging from manufacturing to services.But one thing remains clear, India has stopped counting tariffs and started counting leverage.