Stranded! How H-1B backlogs are creating cross-border tax compliance risks for professionals – The Times of India

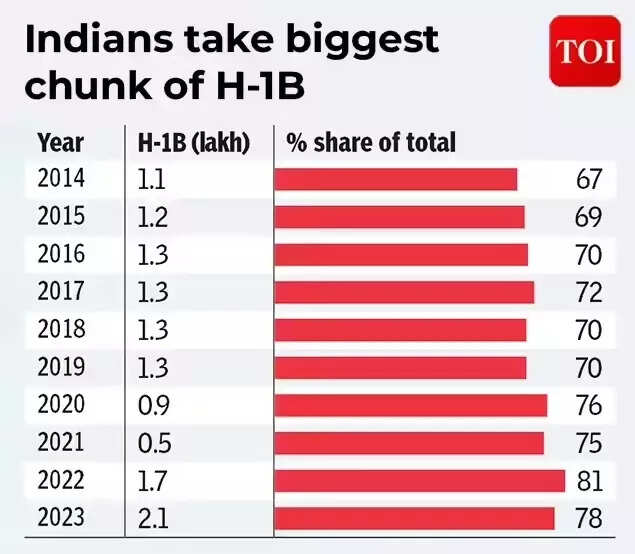

For more than three decades, the H-1B visa program has been a cornerstone of economic integration between India and the United States, enabling movement of highly skilled professionals into sectors critical to US productivity and innovation. Indian nationals account for more than 70% of all H-1B visas issued globally, making India the single largest beneficiary. This has delivered clear tangible benefits to US employers and Indian nationals.

What was once a process characterized by relative predictability has, over the past year, evolved into prolonged uncertainty and anxiousness among Indian nationals. Extended visa stamping delays at US consulates in India have left thousands of H-1B holders stranded outside the United States far longer than anticipated. While the immigration consequences of these delays are widely discussed, the more complex and enduring implications might lie in personal & corporate taxation, social security, and payroll risks which need careful consideration.What has changed in visa processing?Appointment availability across US consulates across cities in India has squeezed dramatically. Applicants witnessed their already scheduled interview dates pushed into late 2026 and 2027 due to backlog and rescheduling. Visa stamping via third countries is also discouraged.

The above reflects a convergence of post-pandemic demand recovery, surging application volumes, staffing constraints at diplomatic missions, annual lottery caps, requests for evidence, expanded security screening for employment-based visas, and reduced eligibility for interview-waiver (“drop-box”) processing. The US Department of State has announced that, effective December 15, 2025, all H-1B and H-4 applicants will be subject to expanded online-presence and social-media vetting. Applicants have been asked to make social-media profiles public, and consular officers may review publicly available posts, professional histories, connections, and any inconsistencies between online content and visa applications. The Department has explicitly stated that adjudication will rely on ‘all available information.’ Additional vetting increases review time raises the likelihood of administrative processing and heightens the risk of follow-up interviews or document requests. For applicants who traveled expecting a short stay for a routine, compliance has transformed into an open-ended disruption, with return timelines getting increasingly difficult to predict.When immigration delays trigger tax eventsStranded professionals continue working remotely from India for their US employers, if their tax position remains unchanged because their employment contracts, payroll, and reporting lines remain in the US This assumption may hold good for short, well-contained periods. As delays stretch into months and now even more than a year, it opens tax exposures.As per India income-tax laws, salary accrues in India for services being rendered in/from India, irrespective of where the employer is located or where remuneration is paid. As a result, salary attributable to days worked remotely from India may be treated as India-sourced income, even if paid into a US bank account by a US employer. The India–US Double Taxation Avoidance Agreement (‘DTAA’ or ‘treaty’) offers potential relief. Article 16 provides a short-stay exemption under which employment income remains taxable solely in the country of residence if all the below conditions are met cumulatively.

- The individual is a Tax Resident of the US (evidenced via a Tax Residency Certificate issued by the US federal revenue authorities).

- The individual does not exceed 183 days of presence in India during an India fiscal year,

- The remuneration is paid by a non-Indian employer, and the remuneration is not borne by, or attributable to, a permanent establishment in India.

In case of breach of the 183-days threshold, coupled with history of stay pattern in India, ‘Resident and Ordinarily Resident’ status may trigger, which has larger ramifications of worldwide income taxation in India. Having said this, treaty relief mechanisms become more complex and administratively burdensome.

US Tax Consequences and double taxationFrom a US perspective, many H-1B holders remain US Tax residents under the substantial presence test despite prolonged physical absence, particularly where the absence is involuntary and the intent to return to USA is clear. As a result, US federal tax on worldwide income continues, and payroll withholding often remains unchanged. State tax residency may also persist depending on domicile and individual state rules.This creates a dual exposure scenario: Indian taxation based on source or residency, alongside US taxation based on residence. Although foreign tax credits are available in the US to mitigate double taxation, mismatches in tax years and timing of tax payments can lead to cash-flow strain and interim double taxation. Employer payroll and corporate tax The consequences extend beyond individual employees. From a payroll perspective, if an employee remains in India for fewer than 183 days and treaty exemption applies, India tax withholding may not be required, but the employer must be able to document the treaty position. Once presence exceeds the threshold mentioned above, Indian tax withholding obligations arise, often necessitating shadow payroll registration and compliance. Where payroll continues only in the United States without Indian reporting, employers may face audit by the tax authorities, even where employees have paid the necessary tax directly through advance tax route or tax return filings.Prolonged presence of employees in India—particularly those engaged in strategic roles such as business development, contract negotiations, client engagement or revenue generating roles—may trigger questions around permanent establishment risk exposure. Authorities may examine the aggregate presence of employees, the nature of their responsibilities, and whether a fixed place of business exists in substance. Social security complexitySocial security adds another layer of complexity. There is no comprehensive India- US social security totalization agreement. FICA withholding continues in the US, while Indian provident fund obligations may arise if the US entity has twenty or more employees stranded in India at any point in time. Dual contribution risk, though often impractical to resolve, becomes a real consideration in extended delay scenarios.Risk Overview

A Compliance challenge created by delayWhat distinguishes the current H-1B backlog from traditional mobility is that the risk exposure arises without intent. Employees did not elect to relocate their work location, and employers did not redesign secondment models. Yet both are required to navigate tax, payroll, social security, and corporate tax frameworks that assume advance planning and conscious structuring.As expanded vetting under Department of State rules comes into effect from December 2025, the likelihood of longer consular processing times increases. This, in turn, raises the probability that temporary travel turns into extended remote work, with cascading tax consequences across jurisdictions.Looking AheadAs H-1B delays persist, the issue warrants attention beyond immigration policy alone. During covid times, such unprecedented delays caused similar tax complexities. The Indian government back then for a very limited period provided for a window to make an application to ‘not consider additional stay in India beyond the individual’s control to determine the tax residential status. The artificial barriers being created to obstruct talent fungibility might impact US Companies reliance on Indian talent – or will it lead businesses to begin moving towards talent rich geographies like India?(Ravi Jain is Tax Partner at Vialto Partners. Vikas Narang, Director at Vialto Partners and Harini Vishwanath, Manager at Vialto Partners have contributed to the article. Views are personal)